11 Signs The Crypto Bull Run Has Started

Table of Contents

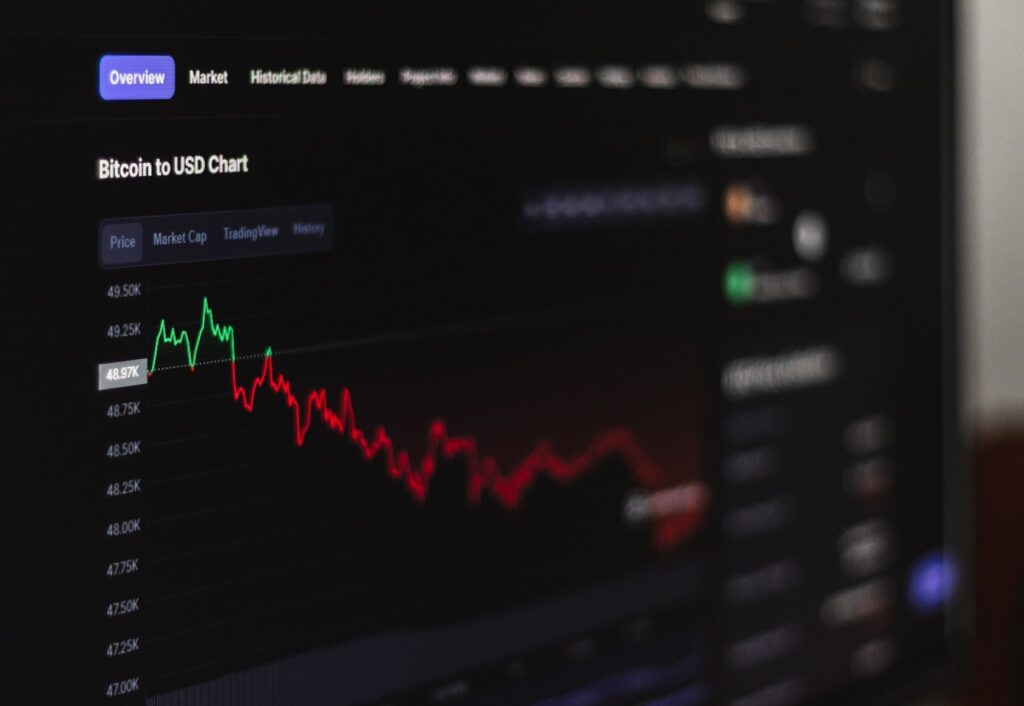

Has the cryptocurrency market finally bottomed? Are we now looking at a major shift from a brutal bear market to the beginning of a new bull market?

Sure, it could just be pure hopium, but this year has the potential to be the beginning of the next bull run in the cryptocurrency market.

Here are the 11 signs to look for to determine whether the crypto bull run has started.

11 Signs The Crypto Bull Run Has Started

Increase in bullish sentiment

An increase in bullish sentiment is one of the clearest indicators that the crypto bull market has begun. Bullish sentiment is defined as a general sentiment of optimism and anticipation for an asset to increase in value. An increase in bullish sentiment is evidenced by higher volumes, larger gains, and increased interest from traders, investors and news outlets.

Other signs of increased bullish sentiment include:

- the presence of more optimistic investors;

- more positive developments in the industry;

- a greater number of positive news stories regarding cryptocurrencies;

- improved technology in the sector;

- accumulating pressure from institutional investor inflows.

It could also be observed through higher trading volumes during periods associated with rising prices (for example upward price spikes or increasing gaps), or the increasing occurrence of sell-side indicators such as net buy levels on exchanges; which has been historically known to foretell a full-fledged straight rally ahead – typically associated with longer periods leading up to it.

Increase in trading volume

An increase in trading volume is often one of the first signs that the crypto bull run has started. When traders become more active and place more orders, it can be indicative of increasing demand and suggests that the market sentiment is becoming more positive.

This increase in volume may also indicate increased liquidity, allowing traders to buy and sell digital assets quickly–helping to drive momentum in the markets. Volume levels that are seen during a bull run may exceed past averages significantly, so it can be helpful to keep an eye on the changes for potential signals of a rally.

Increase in search volume for cryptocurrencies

Increases in search engine inquiries can offer a good indication of the level of interest in cryptocurrencies from the public.

Search volume could be directly related to crypto prices as those looking for crypto-related content can signal a broad investor base and a potential for an inflow of new capital into the market.

The global pandemic has driven recent price increases, but it has also provided an opportunity for people to view cryptocurrency with more serious consideration. With ongoing layoffs, job insecurity, and unprecedented monetary stimulus packages, market sentiment appears to be changing dramatically.

People are investing more money over the course of this pandemic than ever before, making it likely that an increase in searching behavior is indicative of the beginning of a bull run.

Past search trends may provide insight regarding how the interest and demand towards cryptocurrency works. For instance, when Bitcoin was trading at around $3000 in late December 2018 there was a vast decrease in web searches related to Bitcoin and other major cryptocurrencies such as Ethereum and Litecoin.

As we saw throughout late 2019 and early 2020, similar patterns may become repeated – corresponding increases (or decreases) in search engine inquiries often indicate periods where new investors are transitioning into or out of more traditional investments into (or out) of cryptocurrency assets.

An increase in search volume signals that there may be renewed investor sentiment towards cryptocurrencies as markets enter what many analysts see as potential bull run territory – however one should always consider past data trends before investing large sums into any cryptocurrency asset class with confidence.

Technical Analysis

Technical Analysis is often used to identify when a particular asset may be entering a bull or bear market, or even just entering a new trend.

By studying chart patterns, technical indicators, and other market data, traders can determine when to enter a position before a price move has even begun. In the case of cryptocurrency, Technical Analysis can be used to determine when a new bull run has started.

Let’s take a look at some of the key signs that may indicate the start of a new crypto bull run:

Breakout of key resistance levels

Breakout of key resistance levels is one of the most commonly used technical analysis tools in any financial market to determine a bullish trend. Most notably in crypto markets, a breakout above a major resistance level may indicate that a new cycle of higher prices has begun and could be the beginning of a bull run.

Crypto traders use these technical analysis strategies to measure what has been happening in the market and to make predictions about future movements.

A breakout above key resistance levels serves as an indication that buyers have taken over and it can spark bullish price activity. When this occurs, it is important for traders to watch out for other signs that could point towards an imminent bull run:

- Extremely high trading volumes

- Longer duration bullish candles on charts

- Stablecoins selling off due to an increase in demand

- Among other signs

It is also important for traders to set rules for entry and exit points when entering the market during such conditions.

Increase in trading volume

An increase in trading volume is one of the clearest signs that a bull run has started. Volume is typically seen as an indicator of market confidence; it represents how many people are participating in trading and how much money is exchanging hands.

During a bull run, an influx of traders enter the market, resulting in increased transactions across multiple cryptocurrencies. As demand grows, prices trend upward and the overall value of the market increases. This signifies that investors are speculating more and have higher levels of confidence in their positions.

The most accurate way to measure trading volume is by observing historical data. Observing trade price movements over time can provide insight into whether or not current trends reflect true buying pressure or if speculative activity is driving prices up artificially. Additionally, examining data points such as:

- Exchange liquidity

- Buy/sell walls

- Daily active addresses

will give further perspective on whether a crypto bull run has begun or if the current rally is likely to die off soon.

Increase in the number of investors entering the market

The surge of investors entering the cryptocurrency market is one of the most reliable signs that the crypto bull run has begun.

This increase in market activity provides evidence of a rising demand for cryptocurrency and points to a collective sentiment of confidence in the overall value proposition offered by this asset class.

Furthermore, an increased number of investors buying digital assets also serves as indicator that more people are looking to invest in the purposeful potential presented by blockchain technology.

Many individuals are now turning away from “just holding” Bitcoin or other cryptocurrencies, and they are instead trying to collector identify interesting projects and digital assets with solid fundamentals, forward-thinking visions and large development communities working on solving existing world problems.

The rise in capitalization brought on by the inflow of new investors is also an obvious sign that reflects growing interest in cryptocurrencies. When we see significant growth over long periods, this is indicative of potential profits to be made.

It shows that more folks are leaving their comfort zone as traditional financial players take notice – by investing larger amounts of capital into this industry – with trading volumes reaching all-time highs across exchanges globally.

In summary, when there’s a noted increase in investments into both Ethereum and Bitcoin as well as growth across multiple indices showing positive characteristics over time – it’s quite likely that a bull run has begun!

Market Fundamentals

Market fundamentals are essential for understanding and predicting the performance of a asset class. In the case of cryptocurrencies, these fundamentals can be used to determine whether the crypto bull run has started. The most prominent signs to look out for are increased trading volume, breakout in price, and rising open interest in derivatives.

Let’s take a look at some of the other market fundamentals that could indicate the start of a new crypto bull run:

Increase in institutional investments

When institutional investors start taking an interest in crypto markets, it is often seen as a sign that the crypto bull run may have started. Such investors generally have large pools of financial capital behind them and longer-term strategies than retail, individual investors.

Institutional investors possess the resources and knowledge to invest systematically in digital assets with long-term goals in mind.

Institutional-grade technology enables such entities to securely protect their private keys and hold digital assets offline so they are out of reach from cyber threats such as hacking. Institutional investments can provide credibility to digital currencies, helping create sound investment options for individuals who are less tech savvy and may not want to manage their own private keys.

Not only that, but these sorts of investors’ decisions can also back up market movements which indicate an uptrend in the value of cryptocurrencies, leading to higher liquidity available for all participants involved whether they are retail or institutional investors.

Other signs that could indicate the start of a crypto bull run include:

- Increasing trading volumes

- Wider merchant adoption & increased market sentiment

- More awareness & development around blockchain technology

- More mainstream attention

- More regulatory clarity

- More real-world applications

- Fewer cybersecurity incidents resulting in stolen cryptocurrency

- Improved liquidity landscape (number of decentralized exchanges)

- Increase in financial services infrastructure such as secure custodial solutions

- Greater global acceptance (particularly by Central Banks)

- Increased involvement from venture capitalists & angel investors

- Development in cloud computing technology & blockchain scalability solutions like Layer 2 protocols.

Increase in adoption of cryptocurrencies

The adoption of cryptocurrencies, particularly Bitcoin, has seen a considerable rise in recent months. This is evidenced by increased trading volume across various exchanges and higher user numbers in wallets.

Additionally, increasing numbers of retailers and companies have started to accept cryptocurrencies as payment method, a trend that is only expected to grow as the regulatory landscape begins to shape up and users become more comfortable with this new form of payment option.

Moreover, several institutional investors such as hedge funds, private equity firms and venture capitalists are taking steps towards blockchain and are experimenting with cryptocurrency investments. This resurgence in interest levels amongst the investor sector is a clear sign that the crypto bull run may have started trending up again.

Increase in the number of merchant accepting cryptocurrencies

The number of companies, merchants, and service providers that accept cryptocurrencies as payment for goods and services is increasing exponentially.

For example, Microsoft began accepting Bitcoin in 2014, Expedia in 2015 and major outlets like Macy’s and Kmart joined the group in 2017. As the number of merchants continues to grow, it indicates that more consumers are open to using cryptocurrency for shopping.

Furthermore, there is a growing business market for such services as bitcoin ATM’s being deployed by companies like Bitpoint.

Companies such as these serve to bridge the gap between traditional payments systems and digital global economies by allowing consumers to exchange fiat currency (like USD) into digital currencies (like Bitcoin).

These services make it easier for consumers worldwide to take part in cryptocurrency markets without having to own or use a type of cryptocurrency wallet like Coinbase.

When large organizations become involved in cryptocurrency markets it usually signals that the industry is on its way up since these organizations would not typically risk getting involved with an asset or market destined for decline. The widespread acceptance of digital currencies amongst international retail stores and establishments is one solid sign that the crypto bull run has begun!

Network Activity

Network activity is a key indicator of the health of the cryptocurrency market. When trading and usage of cryptocurrencies increase, the overall market sentiment is generally positive and signals a potential bull run.

Network activity is represented by the number of transactions, miners and number of active wallets. Examining these figures can be invaluable in predicting an upcoming crypto bull run.

Let’s take a look at how network activity affects the cryptocurrency market and how to spot the signs of a bull run:

Increase in the number of transactions

An increase in the number of transactions is usually seen near the start of a bull run. This activity can reflect the increased demand to prepare for an upcoming surge in price as well as general optimism from market participants.

Transactions are a reliable metric to gauge demand around cryptocurrencies, and greater than usual transaction activity could be an indicator for an upswing in trading.

Additionally, if more transactions are occurring each day compared to the past months, then this could suggest that more investors are entering the market and exchanging cryptocurrencies. Network metrics such as transaction fees and number of wallets actively used can also provide insight into whether or not a crypto bull run has started.

Increase in the number of active wallets

The number of new wallets created usually increases when a crypto bull run is about to start. This is because cryptocurrencies are becoming more mainstream, and users tend to prepare for higher profits during a Bull Run by creating accounts and small wallets. Additionally, the increase in the number of active wallets may indicate that investors are diversifying their portfolios by investing in multiple different assets and currencies. This is because they are expecting growth when the Bull Run starts, so they’re looking to capitalize on every potential gain.

The increase in user activity may be seen both on public block explorers like Etherscan or etherchain.org and in-app networks such as Metamask or an exchange’s internal wallet system. Specifically, users will look for an increase in daily transaction volume and new wallet creation numbers from these networks/explorers to spot this trend of increased user activity which could signal the beginning of a Bull Run.

Given that cryptocurrency networks are still relatively small compared to centralized assets like stocks, indices, or forex products; even a slight increase can be considered significant enough to bet on a possible upcoming bullish market sentiment shift.

Increase in the number of new projects and development

One of the clearest signs of a Bull Run happening in the crypto currency market is an increase in the number of innovative new projects and development within existing coins. A Bull Run often marks a period of safe, steady growth during which many blockchain technologies gain public trust and interest from investors, developers and users alike. This increased demand leads to more developers creating products and tools around cryptocurrency, as well as more experimentation with existing coins.

During a robust Bull Run, it is quite common to see dozens or even hundreds of new initiatives being launched related to cryptocurrency technology. Activity like this builds on itself until eventually an ecosystem is formed. This can empower renewed activity in other areas across the blockchain landscape, accelerating adoption by even greater numbers of participants.

Media Coverage

One of the first signs that a crypto bull run has started is the increase in media coverage of the cryptocurrency industry. This can be seen through more news articles, videos, and analysis pieces. When the media is talking about cryptocurrency, it’s likely that the cryptos and the overall market are about to enter a bullish phase.

Let’s take a look at the other signs that we may be entering a bull market:

Increase in positive media coverage

Increased positive sentiment from the media is often one of the earliest indications that a bull run is in progress. The crypto market experienced a high level of media coverage during the 2017 bull run with thousands of influencers and publications releasing stories about cryptocurrency investments.

As such, an increase in positive coverage can be seen as an indication that people are becoming more bullish on digital assets, and the market will most likely experience organic growth as a result. Optimistic news stories spread quickly, and they can range from news related to institutional investments into digital assets to successful use cases for current applications of blockchain technology.

Positive media coverage not only serves as a signal that a bull run is happening, it can also increase general public awareness and interest in cryptocurrencies which has a direct correlation with increased trading volume.

With large banks such as JP Morgan now offering their own cryptocurrency-based products, we will undoubtedly see more traditional financial institutions creating services related to digital asset trading in the near future – so keep your eyes peeled for those news stories!

Increase in the number of influencers talking about cryptocurrencies

An unmistakable sign that the crypto bull run has started is the increase in the number of influencers talking about cryptocurrencies. Influencers, such as Redditors and celebrities, play a key role in shifting public opinion and giving new life to emerging technology.

When Twitter CEO Jack Dorsey promoted his own Bitcoin investment in 2018, it was a huge boost to Bitcoin’s market valuation. Similarly, when Twitter CFO Ned Segal recognized Ethereum’s potential during an interview with CNBC this year, it created a stir in the altcoin market and sent prices of Ether soaring.

Apart from these high-level endorsements, there has been increased interest from other influential faces in the tech world. Outspoken Tesla CEO Elon Musk may have initially taken jabs at Bitcoin with his infamous tweets but has since softened his stance and been rumored to make big moves into cryptocurrency investments.

Similarly, Apple co-founder Steve Wozniak publicly endorsed Bitcoin over Gold earlier this year—a significant sign considering he had previously sold all of his BTC holdings back in 2013 when prices weren’t even close to what they are now.

It is also worth noting that more mainstream financial institutions have also increased their involvement with cryptocurrency recently – especially after PayPal released its own crypto trading platform this year which allows users to buy and sell virtual assets instantly. This could certainly be felt as an endorsement from large monetary institutions and will certainly help legitimize investment opportunities within the space moving forward.

These gestures are just some of many that indicate that we are currently on the cusp of a new bull cycle for cryptocurrencies – and if history is any indication we can look forward to an exciting period ahead!

Increase in the number of conferences and events related to cryptocurrencies

As the cryptocurrency market continues to mature, more and more events related to cryptocurrencies are taking place around the world. This can be a sign of increased interest in the sector and could be indicative of an impending bull run. Conferences often bring together industry professionals or investors to discuss the latest trends, advancements, and challenges faced in the sector.

The number of events related to cryptocurrencies has grown significantly since 2017. According to CoinDesk’s 2019 Annual Cryptocurrency Report, there were 437 crypto-industry conferences held around the world in 2019 compared to just 119 in 2017 – an increase of 265%. And with conferences comes innovative ideas which spark new ways for people to invest & benefit from the cryptocurrency market – as well as giving businesses opportunities for growth & expansion in this highly dynamic space.

The sheer number of conferences being organized also shows that institutional & retail investors have become increasingly comfortable with investing into cryptocurrencies. Events focus on topics such as blockchain technology & its potential applications, regulations & compliance procedures for businesses working within the space, how blockchain can revolutionize different industries, security & much more – which suggests that the overall acceptance rate is growing rapidly due to increased education into how this fundamentally transformative technology works and its potential usage cases.

As 2022 progressed it has become even more clear that cryptocurrencies are here to stay – with governments starting their own (digital) currencies or accepting crypto payments such as Bitcoin alongside traditional payment methods like FIAT money.

This growth means good news for current as well as future crypto investors over a long period of time – adding further credibility towards a possible upcoming bull market rally!

READ MORE: Bitcoin Vs Ethereum: What’s The Better Long Term Investment?

Frequently Asked Questions

The 11 signs of a crypto bull run include an increase in trading volume, an increase in the number of initial coin offerings, an increase in the number of projects being developed, an increase in the number of exchanges, an increase in the number of institutional investors, an increase in the regulation of cryptocurrencies, an increase in the liquidity of cryptocurrencies, an increase in the number of startups in the cryptocurrency space, an increase in the number of wallets, an increase in the number of services supporting cryptocurrency trading, and an increase in the number of people interested in cryptocurrency investing.

You can spot the beginning of a crypto bull run by looking for an increase in the volume of trading and the number of new projects being developed. Additionally, you can look for an increase in the number of exchanges, institutional investors, and services that support cryptocurrency trading. Finally, you can look for an increase in the number of wallets and people interested in cryptocurrency investing.

Other indicators that might signal a crypto bull run include an increase in the liquidity of cryptocurrencies, an increase in the regulation of cryptocurrencies, and an increase in the number of startups in the cryptocurrency space.

This is not financial advice and is meant purely as an educational and entertaining article.

In addition, all readers are advised that past investment product performance is no guarantee of future price appreciation.